8 Stunning Examples of Waterfall Charts: Master Financial Visualization Techniques!

A waterfall chart is an effective visual tool to display financial data and changes over a period of time. With its cascading, vertical bar design, waterfall charts help stakeholders easily identify key metrics like net effects, running totals, and individual positive and negative contributions. In this blog, we’ll explore what a waterfall chart is, its unique benefits, and stunning examples of how the versatile chart can be used to share insights and enhance the decision-making process across multiple financial reports and statements.

What is a Waterfall Chart?

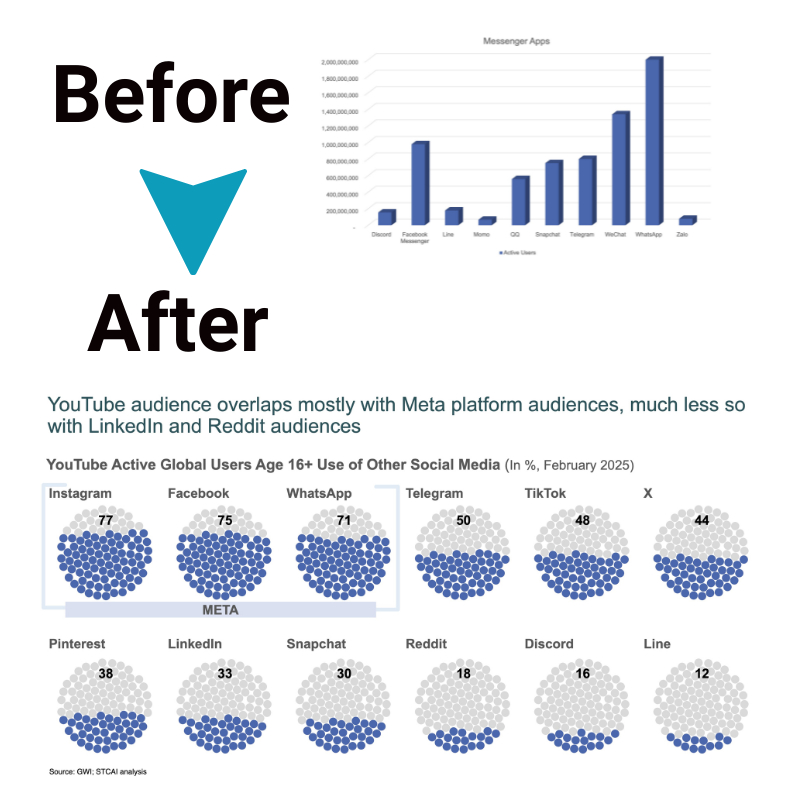

A waterfall chart depicts the cumulative effect of a series of sequential positive and negative contributions to an initial starting value. Traditional bar charts show isolated statistics in a static format. In contrast, waterfall charts outline how various drivers combine in sequence to arrive at a net effect.

The flowing, cascading appearance of the bars has led to the moniker “waterfall” chart. The sequential bars graphically communicate changes over time, across periods, and from category to category through visual means.

Benefits of Using Waterfall Charts

There are multiple compelling reasons why more and more professionals are turning to waterfall charts for financial visualization, analysis, and reporting. Key benefits associated with waterfall model charting include:

- Visual clarity of financial data: Complex numerical data is transformed into an intuitive and cognitively simple visual graphic depicting ups, downs, accumulations, and beginning and ending balances. The key drivers of change are quickly discernible.

- Easy identification of individual contributions: Each sequential bar represents a distinct positive or negative driver. The height of the bar immediately signals if the factor is increasing or decreasing the cumulative flow.

- Simplification of complex data sets: Waterfall charts reduce multifaceted data to just the key components influencing bottom-line outcomes. Minor or immaterial items may be grouped into an “other” category bar.

- Enhanced decision-making process: Seeing the flow and impact of various financial components combined to produce real-world effects allows management to determine where to shift focus, strategy, or resources.

Common Mistakes to Avoid with Waterfall Charts

The most common mistakes that you must avoid are:

- Limit the number of bars: Too many bars on the same waterfall chart can clutter it and confuse readers. Include only the most key contributors as individual bars. Group non-critical items into an ‘Others’ bar.

- Ensure adequate labeling: Make sure to label what each bar depicts clearly through easy-to-read text and state its underlying numerical value. Leaving bars unlabeled hampers interpretation.

- Maintain logical flow: Bars must align left-to-right in a chronological sequence or be ordered according to their strength of influence on the cumulative outcome. Inconsistent ordering misleads readers about the sequence of changes.

- Use color judiciously: Assign no more than 3-4 colors for bars and ensure expenses, revenues, etc, get the same shade across periods. Clashing shades strain readability.

- Size bars appropriately: The width and height of bars should visually correspond to the value they represent. More significant factors must have taller/broader bars, and smaller variables must get slimmer bars.

- Don’t overcrowd the chart: Instead of cramming an entire report onto one graph, design-focused waterfall charts convey key takeaways for P&L, budgets, or costs. Overcrowding dilutes their simplicity.

Stunning Examples of Waterfall Charts

While simple in concept, waterfall charts empower professionals across all types of organizations and industries to convey essential messages more effectively and prompt better financial outcomes. Here are some examples of how waterfall analysis enhances reporting across multiple financial statements.

Example 1: Revenue Analysis

A revenue waterfall chart can visually depict how various factors, like pricing, volume, product mix, discounts, etc, are sequentially driving changes in monthly or quarterly sales. For instance, the chart may show revenue rising $50K due to price hikes but falling $80K later because of seasonal volume drops. This allows CFOs to analyze what’s working and what’s not. They can drill down if needed to get granular insights by region, customer segments or product lines to aid decision-making.

Example 2: Expense Breakdown

Tracking expenditure via waterfall charts simplifies how well organizational spending is being managed. For example, if R&D budget was cut by 15% but related expenses eventually exceeded by 20%, it visually pinpoints oversight issues. Similarly, sales admin costs may have risen despite tighter expense controls. This bird eye view helps execs easily identify outliers, question discrepancies and contain avoidable overspending without micromanaging individual line items.

Example 3: Profit & Loss Statements

Complex P&L statements become far easier to decipher when waterfall techniques distinguish key swings from prior years. Think—how did major metrics like operating margins decline from last year’s 15% to the current quarter’s 3%? Using waterfall analysis quickly depicts that spikes in product recall costs, inventory write-downs, and a dip in gross income were the primary drivers behind the falling profits.

Example 4: Budget vs Actual Analysis

When evaluating annual budgets against year-end expenditures, high variances quickly become apparent via waterfall charts. For instance, surplus funds received from additional government grants or investment proceeds can visually explain the deviation versus original forecasts. Alternatively, shortfalls in expected corporate donations or taxpayer revenues also become conspicuous to facilitate remedial action.

Example 5: Cash Flow Analysis

While direct or indirect methods of presenting operating cash flows have merits, waterfall techniques also add value. They can effectively demonstrate how the final cash position was achieved by displaying the sequence of key inflows like customer receipts and significant outflows like supplier payments or annual tax bills. This simplifies the ascertainment of available liquidity.

Example 6: Project Cost Breakdown

Waterfall charts simplify tracking cumulative costs versus initial estimates for large IT system rollouts, factory expansions, or major organizational projects involving big budgets. Rather than poring over detailed Excel sheets, project heads get a helicopter view of expenditure. For instance, the cost waterfall may reveal that while engineering expenses were contained, significant overruns happened in procuring raw materials or logistics. This allows mid-course corrections. By visually isolating the largest deviation factors, resources can be reallocated from surplus areas to cover the unforeseen excess.

Example 7: Sales Performance

On sales teams, every member carries individual targets that contribute to the broader revenue goal. Waterfall graphs can instantly highlight outlier performances at granular levels. For example, sales reps A and B delivered numbers steadily above their quotas across quarters. However, rep C’s contribution dipped below the target in Q3 and Q4, resulting in the overall region underperforming. With this quick diagnosis, the sales head can probe why C faltered, arrange remedial coaching or mentoring, and get them back on track the next year. Such an agile corrective response is only possible with the clarity of waterfall analysis.

Conclusion

As data and analytics become increasingly crucial for organizational decision-making, waterfall charts provide valuable visibility through easy-to-grasp visual flows. Whether executives monitor costs, project heads analyse budgets, or sales managers evaluate team performance, waterfall modeling enables the isolation of factors driving outcomes.

With entire financial narratives presented through simplified cascading bars highlighting key variances, waterfall best practices are vital for turning complex numerical data into insightful, actionable analysis across functions. Adopting this agile financial reporting technique is key to simplifying complexity in business contexts.