Simplifying Financial Data: Using Slope Graphs to Compare Key Business Metrics

In today’s data-driven business world, financial analysts and business leaders often find themselves awash in complex data sets and financial reports. Extracting key insights can be a major challenge. However, simple data visualization techniques like slope graphs can help cut through the complexity and highlight the most important trends and performance indicators over time.

This article will explain what slope graphs are and why they are useful for financial analysis.

What are Slope Graphs?

A slope graph is a type of data visualization that displays the change in quantitative data over intervals of time. It plots data series as lines that rise or fall from left to right, allowing viewers to spot increases, decreases, and trends easily.

Slope graphs are named because the angled lines resemble sloped hills and valleys. The slope or angle of each line corresponds to its rate of change. Steeper lines represent rapid change, while flatter lines indicate gradual shifts.

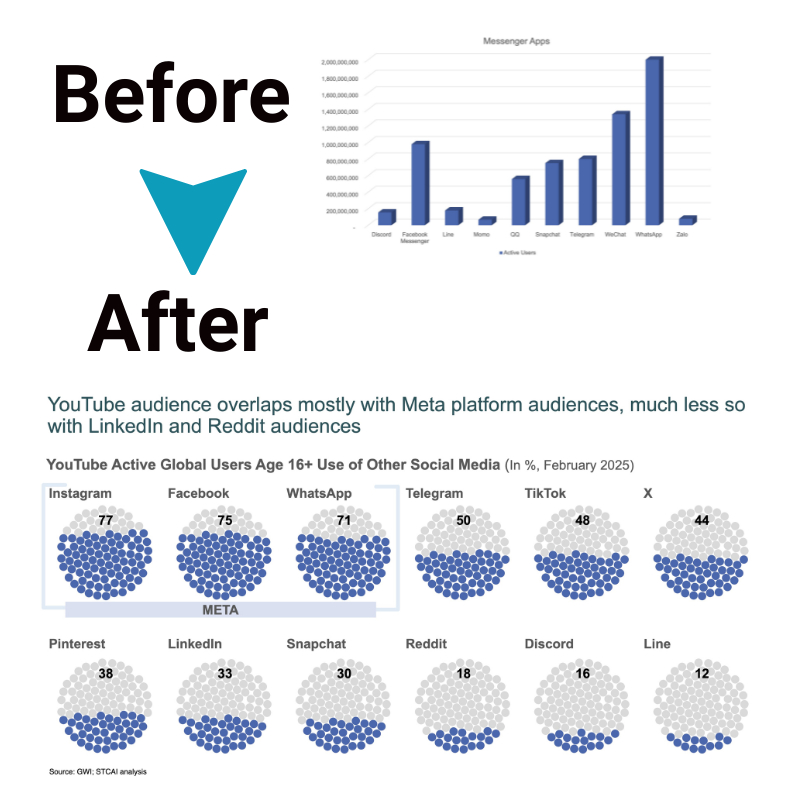

Compared to complex line or bar graphs, slope charts use minimal design elements to focus on key data trends. Axis scales, numbers, and categories are removed, preventing information overload. The simplified graphical form allows viewers to grasp the core insights quickly.

Why Use Slope Graphs for Financial Data?

Several key advantages make slope graphs well-suited for conveying important financial information:

Simplify Complex Data Sets

Financial data can often be overwhelming, with massive Excel spreadsheets full of numbers, percentages, and complex calculations. It becomes difficult to see the bigger picture and key trends. Slope graphs help cut through the noise. Slope graphs eliminate clutter by plotting only the most important key performance indicators (KPIs) over time.

Spot Performance Trends

Complex financial reports may disguise whether key metrics improve or decline over sequential periods. Slope graphs make the trends obvious at a glance. Viewers can clearly see if a line is steadily rising, dramatically falling, or fluctuating up and down over time—no confusing numbers needed. The direction and slope of each line intuitively communicate the rate performance is accelerating or decelerating.

Compare Changes Over Time

Slope graphs allow financial analysts to contrast multiple metrics together on one graph. Comparing two or more measures over the same time intervals highlights how they relate to and potentially impact each other. For example, plotting both revenue and expense slopes reveals if one is growing faster. Seeing conversion percentages rise while transaction sizes decline provides insight into sales. Comparing metrics like these would be tedious with traditional reports.

Save Time While Improving Insights

Typically, creating custom financial charts and graphs is complex, requiring significant manual work to assemble specific data and format complex graph designs. Slope graphs strip all that away using Excel’s default line chart. No axes, scale numbers, gridlines, or data markers clutter things. The process is simple and fast. Since the simplified graphs also communicate insights quickly, business leaders save time both creating and interpreting them compared to traditional financial graphs or tables. The easy visualization improves focus on what matters most.

Intuitive Format

Financial reports are often full of numbers, text, and technical jargon and make sense only to accounting and finance experts. Slope graphs use universal visual language, though. Lines angling up = growth, down = decline. Removing all non-essential elements makes the core direction and degree of change intuitively obvious. The simpler format allows everyday managers, staff, and even external stakeholders to digest performance meaning without advanced financial literacy. More universal comprehension enables better collective decision-making.

How to Create Slope Graphs in Excel

Constructing basic slope graphs in Excel only takes a few simple steps. Follow this process:

1. Input time intervals in Column A (for example, Q1, Q2, Q3, and Q4 for quarterly data).

2. Enter corresponding metric values for each period into columns B, C, and D (one column for each data series you want to plot).

3. Highlight the data table and insert a 2-D line chart with markers.

4. Delete legend, axis titles, gridlines, and data markers.

5. Display clean lines spanning from left to right.

For example, to compare quarterly revenue and profit time series, input quarters in Column A, revenues in Column B, and profits in Column C. Generate a slope graph from this data showing two sloped lines representing the changing trends over time.

Customizing and Enhancing Slope Graphs

Simple tweaks can optimize slope graphs for full impact:

- Add a descriptive title explaining key focus

- Include concise data labels directly on lines

- Vary line colors and styles for distinction

- Thicken lines for greater visibility

- Sort time intervals ascending or descending

Consider integrating slope graphs into Excel dashboards alongside complementary charts for deeper multidimensional analysis. Powerful dashboard software provides additional customization flexibility.

Slope Graph Example and Template

The following example displays a slope graph comparing three important e-commerce metrics over five sequential quarters: website traffic, conversion rate, and revenue. Examining the intersecting lines clearly conveys the key trends, including rapid traffic growth fueling rising revenues despite a flat conversion rate.

See the supplemental Excel template demonstrating how to build this sample slope graph step-by-step. Input your own financial data into the predefined template to rapidly generate customized slope graphs for tracking business performance.

Conclusion

Slope graphs excel at simplifying complex financial data to highlight significant trends across key metrics over defined periods. Their straightforward visual design cuts through the clutter to showcase critical performance insights. Following the tips outlined above, analysts and managers can easily construct informative slope graphs using Excel or other visualization tools to track revenue growth, web traffic, operational efficiency, and more to inform smart strategic decisions.

Integrating these concise graphs into reporting and dashboards augments analysis capabilities for better financial oversight. Give slope charts a try for maximizing comprehension while minimizing effort when evaluating essential business metrics.