How to Do Time Series Analysis Like a Pro: Techniques and Tools for Presentations

Time series analysis of any data is information collected sequentially over time. It’s all around us—stock prices over months, website traffic by the day, weekly sales figures, and hourly temperature readings. Understanding trends and patterns in time series data is crucial for businesses, researchers, analysts, and policymakers.

Effective time series analysis and time series comparison require the right techniques and tools. In this article, we’ll explore the essentials of working with time series, from data preparation to visualization to advanced modeling.

Understanding Time Series Data

Time series data has a unique attribute – the order and timestamps of the observations matter. Plotting the values over time often reveals exciting trends, seasonality, and cycles that can provide important insights. To properly analyze time series, we must first understand its key components. All time series contain a trend, which tracks the general direction of data over a long period. Seasonal variations also repeat each year, quarter, or month.

Many series display cyclical patterns that fluctuate above and below the trend over several years. Finally, irregular components represent random noise and anomalies in the data. Disentangling these underlying structures helps explain what’s driving changes in the metrics.

Importance of Time Series Analysis in Business and Research

Businesses rely on time series analysis and time series comparison across many functions. Sales and revenue patterns show demand evolution to guide strategy and operations. Website traffic trends help optimize marketing campaigns. Manufacturing outputs and inventory levels rely on predictive demand forecasting.

Researchers also extensively analyze time-dependent phenomena in various domains, such as economics, climate science, and epidemics. By recognizing patterns or deviations, professionals can make better decisions, extract insights, and improve forecasts. Time series and time series comparison methods are invaluable tools for understanding the past and preparing for the future.

Preparing Your Data for Analysis

It’s critical to properly prepare time series data before applying sophisticated techniques. First, diligently collect observations at consistent, frequent time intervals, such as daily, weekly, or monthly. Then, scrub the data – verify its quality, check for entry errors, and interpolate any missing values sensibly. Outliers require investigation to label as true anomalies or fixable errors.

Dealing with non-stationarity through transformations like differencing helps many standard models. Finally, splitting the data into training and validation sets lets you develop models on historical data and test their accuracy on held-out data. These steps form the foundation for insightful analysis and effective time series comparison.

Exploratory Data Analysis (EDA) for Time Series

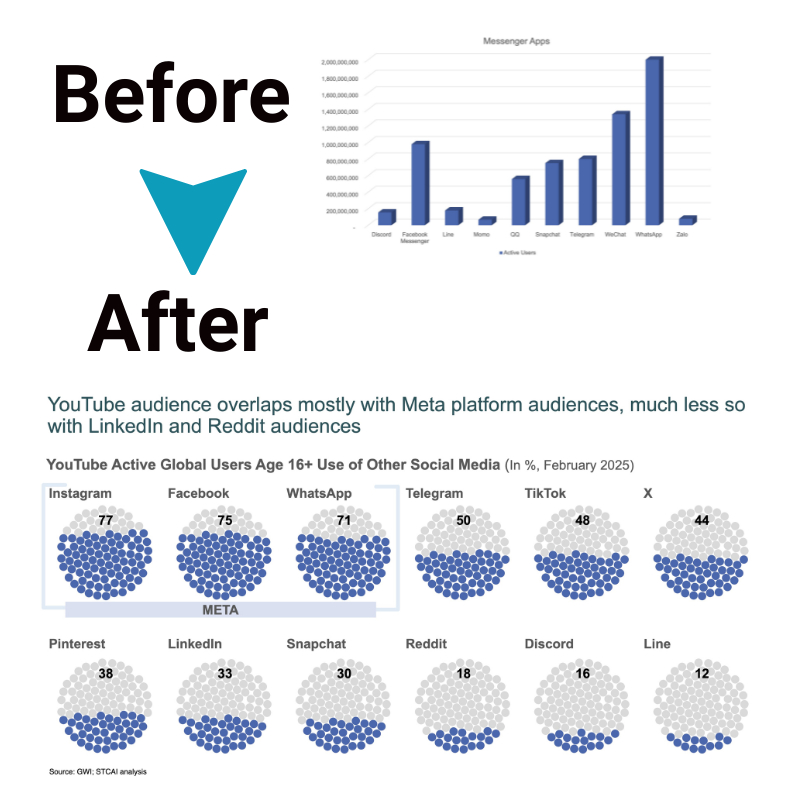

Insight often begins with visualization. Simple plots like line charts immediately reveal striking patterns, if any exist. Overlaying different variables on the same chart helps uncover lagged relationships. Transforming the scale through logarithms or moving averages clarifies short-term fluctuations. Calculating descriptive statistics like means, medians and standard deviations provides initial numeric characterizations.

Decomposing the variation using seasonally adjusted or smoothed versions filters the trend from noise. Tracking anomalies in isolation indicates outliers that require special treatment. Such visual and quantitative EDA techniques point analysts towards hypotheses about patterns or predictors to test formally and guide time series comparison.

Advanced Time Series Analysis Techniques

When initial exploration is complete, more rigorous statistical techniques can provide deeper insights into your time series data. A few commonly used methods for modeling, forecasting and understanding the underlying structures include:

1. Seasonal decomposition: This technique formally separates out a time series’s trend, seasonal, and irregular components. It helps understand which factors drive changes in the data over short vs. long periods.

2. ARIMA modeling: ARIMA stands for AutoRegressive Integrated Moving Average. It’s a widespread and useful technique for forecasting univariate time series data after accounting for past dependence and differencing to make the data stationary.

3. VAR or Vector AutoRegression: This allows simultaneous modeling and forecasting relationships between multiple time series variables. It helps understand how changes in one variable impact others over time.

4. Seasonal ARIMA: This extends basic ARIMA but specifically handles seasonality patterns more rigorously than standard ARIMA.

5. Exponential smoothing: Similar to ARIMA but makes different assumptions, this focuses on smoothing out fluctuations to better capture trends and seasons.

6. Bootstrapping: Re-sampling the residuals from a fitted model helps quantify our forecasts’ uncertainty based on historical data variations.

7. Transfer functions: Sometimes, other external factors may be driving your process. Transfer functions let you explicitly incorporate these correlated “regressor” variables into your time series model.

8. Cross-validation: This is important for testing if your models trained on history still predict recent and future data well. It helps avoid overfitting boring patterns from the past.

Tips for Effective Presentations

- Set the context: Tell your audience about the problem/question upfront so they understand why you analyzed this data and what it could help solve.

- Visual summaries: Charts that showcase patterns are far more digestible than lists of numbers. Annotate to call out important sections.

- Report metrics: Things like accuracy scores build confidence that your approach worked well versus random guesses.

- Explain: Leave out the jargon and use everyday analogies so non-experts readily grasp techniques like “smoothing is like applying a gentle filter”.

- Limit content: Too much information can be overwhelming. Instead of listing everything done, focus on key 4-5 compelling takeaways.

- Interactive Q&A: Be prepared to refocus the discussion on the original objectives and reexplain in multiple ways to convey the learnings effectively.

The Bottom Line

Time series analysis requires dedicated techniques and tools, from collecting raw data to modeling trends to presenting results. Like any skill, regular application is key to mastering this domain. Stay curious by experimenting with new types of timestamped data from diverse applications.

Read research papers to learn advanced methods and improve your intuition. Most importantly, keep asking questions about your data—with each new insight comes an opportunity. Stay focused on offering value to decision-makers, and time series analytics will continue to serve your needs and those you help through data-driven solutions.