Enhance Sales Reporting: How Radar Charts Help Compare Business Metrics Effectively

Sales figures, conversion ratios, deal velocities, and other KPIs quantify the performance of your team. They indicate whether your sales process is humming or needs tuning. However, the extensive data and standard reporting formats – endless rows of tables, busy bar graphs – don’t always translate into quick, actionable insights.

This is where radar charts provide a game-changing analytical edge. Their versatility, clarity, and visual pop make radar charts ideal for transparent sales reporting. Let’s explore how incorporating radar charts can revolutionize the way you track and communicate key sales outcomes.

Understanding the Radar Chart

A radar chart, also called a spider chart or star chart, is a graphical format used to display multivariate data – 3 or more quantitative variables on the same chart. It consists of a sequence of spokes in a web-like design (like a spider web), with each spoke or axis representing a different variable.

The length of the spoke reflects the magnitude or value of the data point being plotted. Joining the data points forms a polygon. Comparing the shapes and areas of these polygons illustrates the variations between data sets—whether periods, sales reps, or product groups.

Benefits of Radar Charts for Sales Reporting

Radar charts fill this gap by capturing all critical metrics in a unified visual design. Their unique benefits include:

1. Holistic snapshot: Radar charts allow you to monitor numerous variables in a single view instead of checking sales figures across scattered reports.

2. Pinpoint highs and lows: The polygons instantly highlight metrics exceeding goals (peaks) or lagging targets (troughs). So you can spot laggards and top performers at a glance.

3. Track trends: Comparing radar chart shapes across months or quarters immediately makes positive and negative trends apparent.

4. Benchmark against competitors: Plotting your sales radar chart and overlaying it over industry average charts shows where you lead rivals or have ground to cover.

5. Simplify data analysis: Unlike dense tables or clustered bar graphs, radar charts simplify data absorption for quicker insights. The visual design is inherently intuitive even to less quant-savvy audiences.

Steps to Create Sales Radar Charts

Step 1: Choose relevant sales metrics

A balanced radar chart should track metrics spanning these 3 categories:

- Sales Volume – Number of leads, meetings, proposals to gauge quantity

- Sales Efficiency – Conversion rates, sales cycle times denoting process efficacy

- Sales Outcomes – Deal sizes, and contract values indicating commercial impact

Limit spokes to 6-8 key variables that provide the best overall picture.

Step 2: Standardize measurement scales

Chosen KPIs may have disparate units of measurement – percentages, currency amounts, and days. Standardize them to a unified scale to prevent visual distortion.

Convert all variables to a 0-100-point scale for balanced comparison. The maximum historical highs for each metric become 100, and the minimums become 0.

This helps overlay charts of different data sets.

Step 3: Plot target threshold lines

Circle the chart at 25, 50, and 75 levels to denote low, medium, and high-efficiency quadrants relative to internal goals. This instantly highlights metrics that need to catch up to goals or exceed expectations.

Step 4: Maintain consistent axes for periodic comparisons

To enable tracking trends over weeks or quarters, maintain identical metrics on chart spokes across reporting periods. Sales volume KPIs should align on the same axes month-to-month.

Step 5: Visualize multiple data sets

Sales managers can plot data for individual reps, product lines, or regional teams on the same radar chart with different-colored polygons. Comparing areas and shapes quickly shows the highest and lowest performers on key metrics.

Radar Charts in Action

Now let’s see radar charts in action across a few common sales reporting scenarios:

Comparing Sales Reps or Products

Plotting metrics for your various sales reps or products on a shared radar chart makes it easy to identify outperformers and laggards across criteria such as:

- Monthly recurring revenue

- Average contract value

- Sales cycle length

- Lead conversion ratios

- Customer retention levels

- Net promoter scores

Such comparative analysis helps managers provide targeted coaching to low performers while replicating best practices across teams.

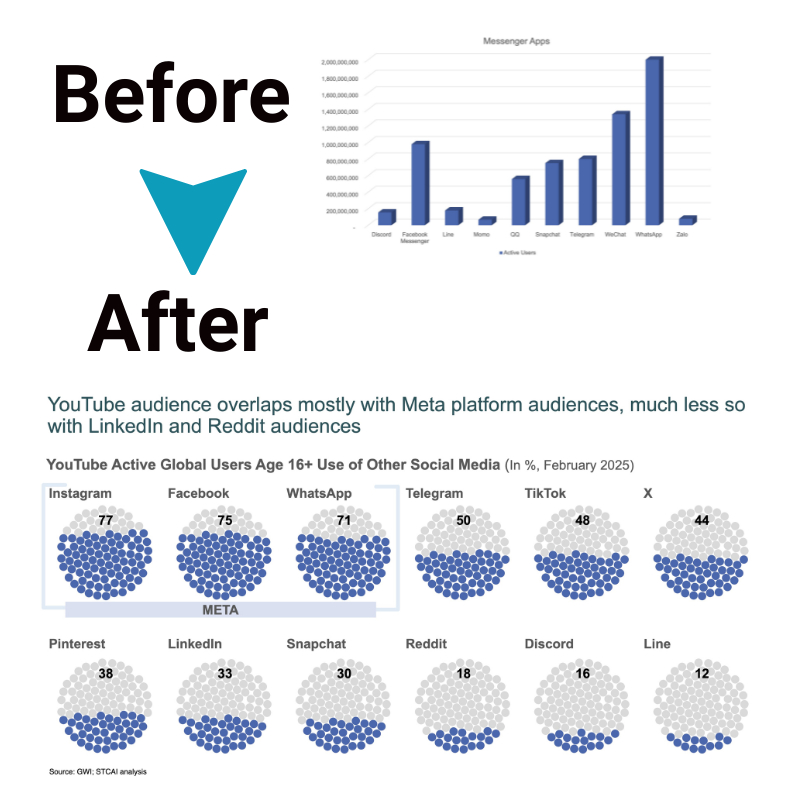

Monitoring Campaign or Initiative Effectiveness

Sales leaders often run promotions, test pricing changes or launch marketing campaigns to achieve targets. Conventional reports need help to correlate such efforts.

Radar charts solve this by visualizing KPIs before and after the changes. Comparing shapes ties campaign outcomes to metrics like:

- Lead volume

- Cost per lead

- Conversion rates

- Win rates by opportunity stage

- Average deal values

The graphic impact quantifies whether the initiatives delivered on their objectives.

Setting Goals by Segment

Not all products, customer tiers, or markets have identical sales cycles or conversion benchmarks. Radar charts allow you to set defined efficiency thresholds personalized to each customer profile or product grouping.

For example, complex enterprise solutions likely warrant longer sales cycles versus simpler SMB offerings. Radar charts can incorporate such nuance into goal-setting across spokes like:

- Sales qualified lead definition

- Expected deal completion rates

- Average forecasting accuracy

- Target contract values

This leads to more meaningful goal monitoring tailored to segment dynamics.

Share Data-driven Insights with Stakeholders

Radar charts make keeping executives and sponsors updated easier because they simplify complex sales data into visually intuitive formats. Non-sales audiences can readily grasp core messages around:

- Total addressable revenue by market

- Share of business against goal

- Lead sourcing or conversion chokepoints

- Competitor pressures across solution areas

This expands engagement across the management chain to align stakeholder support.

Embedding Radar Charts in Reports and Dashboards

Modern BI tools like Tableau, Power BI, and Google Data Studio make incorporating radar charts into existing sales reports and dashboards simple. Their drag-and-drop interfaces allow for efficiently mapping selected metrics onto radar chart axes.

Sales analytics teams can dynamically filter radar visualizations by rep, product, region, or time frame. Tapping into automatic data connectivity pulls updated figures from the underlying data warehouses to refresh charts as new numbers arrive.

This results in highly interactive radar chart-powered sales reporting, allowing drilling down into areas of interest.

Best Practices for Sales Radar Charts

Follow these tips to maximize radar chart efficacy:

- Include only strongly correlated sales metrics rather than adding stray variables that can distort trends

- Keep the number of metrics reasonably low (under 8) for the cleanest visualization

- Use consistent criteria and scales across periodic comparisons

- Plot thresholds at 25/50/75 levels to define performance quadrants

- Highlight outperformers and low performers using annotations

- Maintain visual consistency in chart design across reports for intuitive analysis

The Bottom Line

Mastering core sales metrics and reports remains vital for leaders seeking to guide high performance. However, traditional tabular data and dynamic bar charts have major limitations. They do not provide intuitive visual summaries for quick pattern recognition.

This is the game-changing advantage offered by radar charts. Their versatility, simplicity, and graphical pop simplify complex sales data analysis for speedier insights. Equipping teams with such transparent reporting motivates productivity while helping managers provide crisper coaching.